can you look up a tax exempt certificate

If you sell online and have customers from other states this can get tricky. We are open Monday through Friday beginning at 6 am.

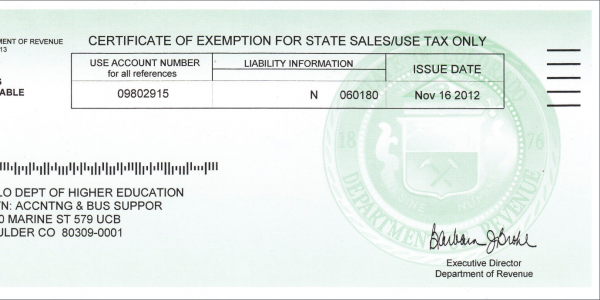

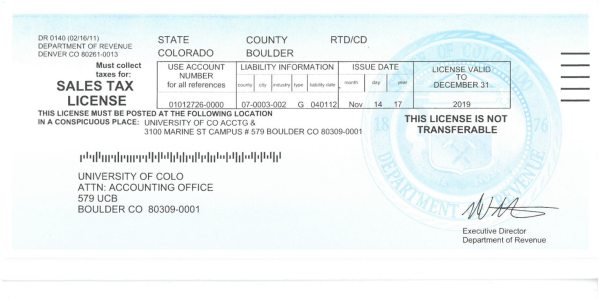

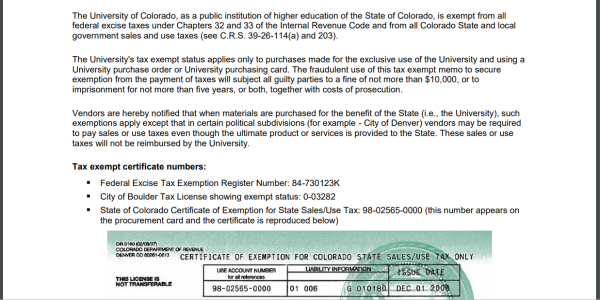

Sales Tax Campus Controller S Office University Of Colorado Boulder

For more information on how to determine your sales and use tax rates please see California City County Sales Use Tax Rates.

. If you try to sell the property you may have to pay off the judgment lien before receiving any of the sale proceeds. If you select this method please print out the Internet Payment Voucher and mail it in with your check or money order. These records are usually searchable online via the Secretary of State website for free.

The tax collection and payments should be part of your business plan and part of the homework you do when you set up your business. For example if you bought some new pots and pans in your luggage the dollar threshold would be applied to those items but not your clothes medications etc. Meaning that you can bring additional items with you.

Those items are exempt from duty and dont count toward the dollar thresholds. Following tax law changes cash donations of up to 300 made this year by December 31 2020 are now deductible without having to itemize when people file their taxes in 2021. As far as adult responsibilities go paying council tax is one wed all rather do without.

COVID Tax Tip 2020-170 December 14 2020. You can look up a business by the legal name fictitious name or individual owner name. As you fill out the form whether you take a new job or have a major life change you might wonder am I exempt from federal.

Under the Tax Exempt Entities tab youll find highlights of how tax reform affects retirement plans tax-exempt organizations and tax-advantaged bonds. You use a Form W-4 to determine the determine how much federal tax withholding and additional withholding you need from your paycheck. Retirement plans Rollovers of retirement plan loan offsets If your plan offsets an outstanding loan balance when you leave employment you have until the due date of your individual tax return plus.

Citation needed In the United States corporations can sometimes be taxed at a lower rate than individuals. When you apply for your business tax certificate you are required to provide your approved Zone Clearance document. Lets take a look at what you need for a Pennsylvania sellers permit.

The Coronavirus Aid Relief and Economic Security Act includes several temporary tax law changes to help charities. If you need an additional or replacement copy you can print one through your Business Online Services Account. If you dont have an account enroll here.

Last tax season more than 75 of taxpayers received a tax refund and the average refund was close to 3000You can get started now with TurboTax and get closer to your tax refund and if you. UpCounsel accepts only the top 5 percent of lawyers to its site. Now that youve opened up shop youll need a sellers permit to collect taxes.

If youre planning on filing exempt on taxes for 6 months or an even longer time you might wonder how you can best prepare for a larger tax bill. This is available for electric cars and motorcycles whether for business or personal use. Also corporations can own shares in other corporations and receive corporate dividends 80 tax-free.

If a creditor records a certificate of judgment in the county records office it can create a judgment lien. Sales Tax Certificates Form ST-4 Your certificate must be displayed prominently at your registered location. You can look up a tax rate by address or look up tax rates by city and county.

If youre considering doing any sort of business that involves a fee or tax in Florida you probably need a sellers permit. For five years or less you pay only US. We are open from 700 am.

These certificates are issued by the New York State Department of Taxation and Finance DTF. For payments made before the return due date you may enter a settlement date up to and including the due date. Form 8936 will help you determine your credit amount.

What About Personal Property. Provided you are not required to remit electronic payments you can choose to pay by check or money order. Kansas Department of Revenue-issued tax-exempt entity sales tax exemption certificate showing state-issued exempt organization ID number Form PR-78SSTA.

The entire Form ST-28H including the direct purchase portion must be. The Business Specialty Tax Line at 800-829-4933 can help you find your EIN. You can also get a copy by calling Customer Services at 8043678037.

Using her newfound legal knowledge she obtained 501c3 tax-exempt status and grew her nonprofit into an organization that has served 1689 students and has awarded 34 college scholarships. You can qualify for a tax credit if you purchased a qualified plug-in electric vehicle during the year for up to 7500. It may also permit you to buy products from suppliersmanufacturers without paying sales tax on them.

After youve incorporated obtaining federal tax-exempt status is a critical step in forming a nonprofit organizationMost of the real benefits of being a nonprofit flow from your 501c3 tax-exempt status such as the tax-deductibility of donations access to grant money and income and property tax exemptions. As a result Revolution Leadership receives major grants from Wells Fargo Enterprise as well as corporate sponsorships from Wal-mart Olive Garden and. The vendor keeps the certificate and makes a sale without tax.

Businesses complete the certificate and provide it to the vendor. How Do I Look Up An EIN Number In Illinois. You may also apply in person at the Business Tax Division public counter in Fresno City Hall.

It can end up costing. Youll need to know the IRS exemption policy examine your tax deductions and general tax situation and review potential penalties you could face. You may apply for your business tax certificate online or by mail with our printable Business License Tax Certificate Application.

Every state maintains a public database of businesses and corporations legally authorized to conduct business. Form W-4 tells an employer the amount to withhold from an employees paycheck for federal tax purposes. However the creditor can seize ownership shares in the corporation as they are considered a personal asset.

Businesses can apply for certificates that exempt them from paying sales tax on certain items. But before you go spending your council tax fund or putting it in a savings account its worth noting that there are some situations where you might have to cough up. If you need help determining whether or not you can file exempt you can post your legal need on UpCounsels marketplace.

Social Security tax and you are exempt from foreign tax. The homestead exemption in your state impacts just what this would look like for you. Credit for federal fuel taxes.

They last up to 90 days. Its more than likely you dont have to pay it. On the other hand if you were hired in one of the listed agreement countries or sent to that country for more than five years you generally will pay social security taxes only to that country and will be exempt from paying US.

Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience including work with or on behalf of companies like. If youre a full-time student though weve got some very good news. To view notices of tax rate changes please go to Special Notices on our website.

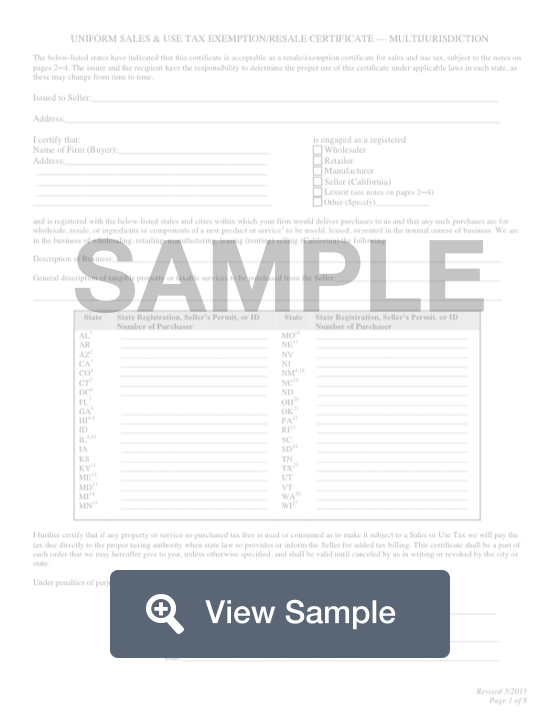

Look up the EIN on state records. If you want to sell online temporarily you can get a temporary sellers permit. Instead you can give your supplier a resale certificate when you buy products that you either wholesale or retail in your online store.

Or Designated or Generic Exemption Certificate ST-28 that authorizes exempt purchases of services.

Sales Tax Campus Controller S Office University Of Colorado Boulder

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

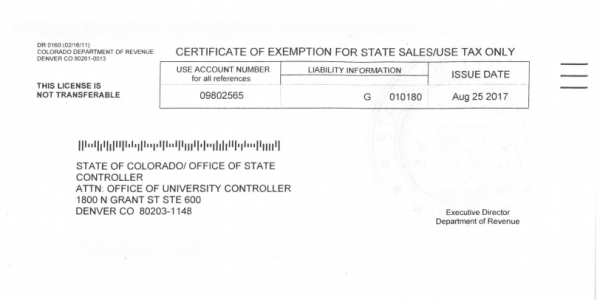

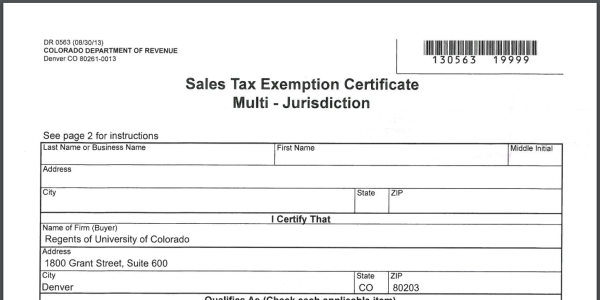

Sales Tax Campus Controller S Office University Of Colorado Boulder

Sales Tax Campus Controller S Office University Of Colorado Boulder

Do I Have To Pay Sales Tax What If I Am Tax Exempt Techsmith Support

State W 4 Form Detailed Withholding Forms By State Chart

What Do Tax Exemption And W9 Forms Look Like Groupraise Com

What Do Tax Exemption And W9 Forms Look Like Groupraise Com

Free 10 Sample Tax Exemption Forms In Pdf

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Sales Tax Campus Controller S Office University Of Colorado Boulder

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

/ScreenShot2021-02-12at5.09.36PM-b75ba9a9a4d64190a7e9d8297218886a.png)

Form 990 Return Of Organization Exempt From Income Tax Definition

Tax Exemption Form Free Tax Exempt Certificate Template Formswift